Simple Moving Average (SMA)

I want to try and understand some existing algorithmic trading strategies. I suspect that the one trend we've found is probably a feature of a different strategy and its best on to reinvent the wheel. We're gonna start with a Simple Moving Average (SMA) strategy. The most basic form of this is taking an n-moving average line and if the stock price is above this line, it indicates the price is moving up. If the stock is below this line, it indicates that the price is moving down. I'm not going to hold any short positions.

We'll be using some code produced in a different post to collect and prepare the data.

| Close | Volume | Average Tone | Article Count | All Articles | |

|---|---|---|---|---|---|

| 2024-01-02 | 466.663971 | 123623700 | 0.1338 | 7402.0 | 113699.0 |

| 2024-01-03 | 462.852875 | 103585900 | -0.0392 | 8467.0 | 140100.0 |

| 2024-01-04 | 461.361969 | 84232200 | -0.0177 | 11418.0 | 171729.0 |

| 2024-01-05 | 461.993896 | 86060800 | 0.0540 | 9509.0 | 159932.0 |

| 2024-01-08 | 468.589294 | 74879100 | 0.1491 | 8584.0 | 145645.0 |

| ... | ... | ... | ... | ... | ... |

| 2024-12-20 | 591.150024 | 125716700 | 0.4267 | 11918.0 | 170707.0 |

| 2024-12-23 | 594.690002 | 57635800 | 0.3075 | 10892.0 | 169788.0 |

| 2024-12-24 | 601.299988 | 33160100 | 0.4874 | 8868.0 | 132293.0 |

| 2024-12-26 | 601.340027 | 41219100 | 0.4670 | 9350.0 | 142705.0 |

| 2024-12-27 | 595.010010 | 64969300 | 0.1646 | 10576.0 | 158638.0 |

250 rows × 5 columns

We will be using a SMA with and we will optimise later. The first thing to do is setup a strategy class. I've decided to avoid

from backtesting import Strategy, Backtest

from backtesting.lib import crossover

class SMA_1(Strategy):

n = 5

def init(self):

self.sma = self.I(SMA, self.data.Close, self.n, name = f"SMA ({self.n})")

def next(self):

if crossover(self.data.Close, self.sma):

self.buy()

if crossover(self.sma, self.data.Close):

self.position.close()

bt = Backtest(data, SMA_1, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

stats

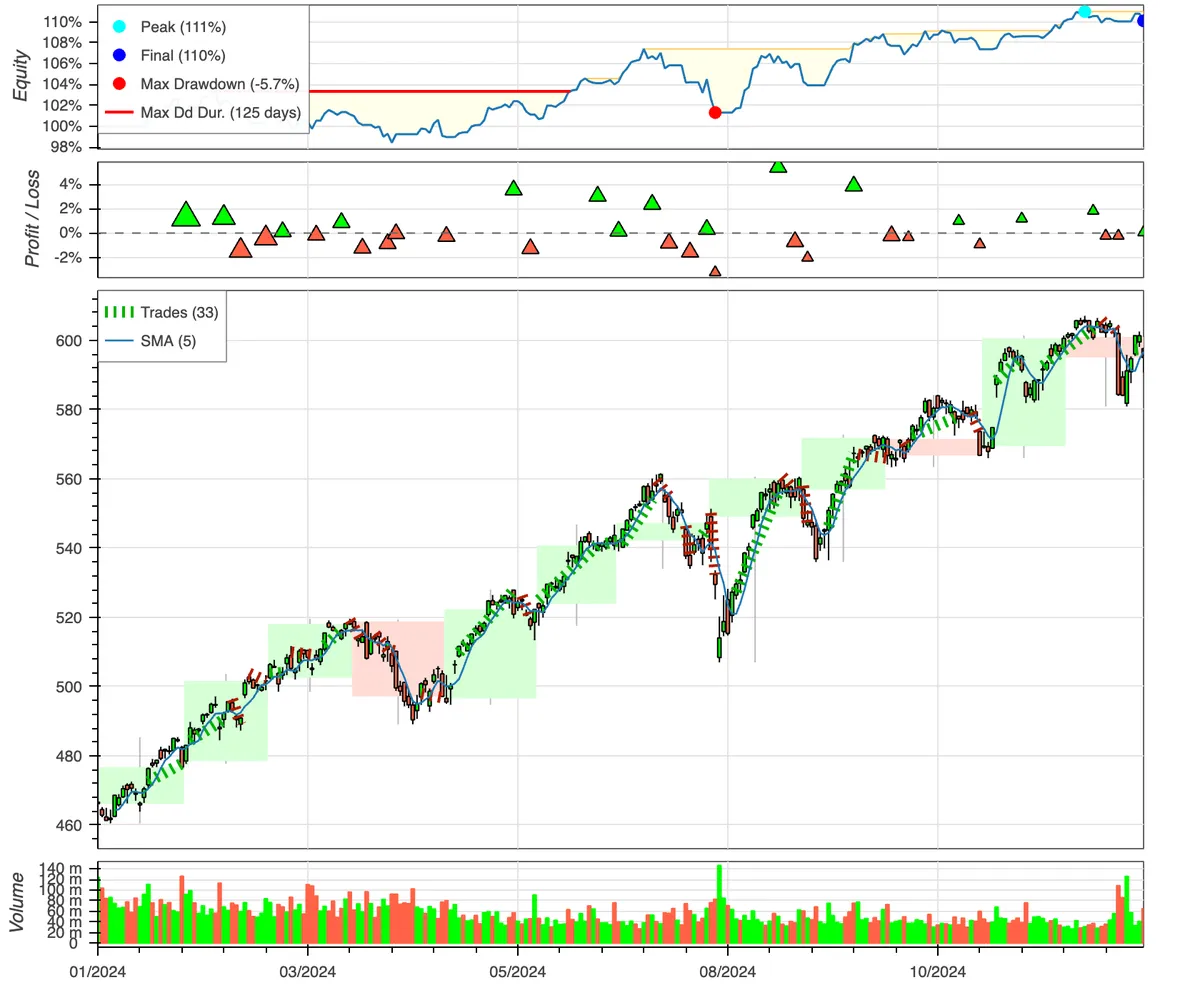

Start 2024-01-02 00:00:00

End 2024-12-27 00:00:00

Duration 360 days 00:00:00

Exposure Time [%] 76.4

Equity Final [$] 11009.11741

Equity Peak [$] 11098.146572

Return [%] 10.091174

Buy & Hold Return [%] 27.502881

Return (Ann.) [%] 10.175879

Volatility (Ann.) [%] 9.22326

Sharpe Ratio 1.103284

Sortino Ratio 1.741219

Calmar Ratio 1.792502

Max. Drawdown [%] -5.676915

Avg. Drawdown [%] -1.350592

Max. Drawdown Duration 125 days 00:00:00

Avg. Drawdown Duration 23 days 00:00:00

# Trades 33

Win Rate [%] 45.454545

Best Trade [%] 5.398761

Worst Trade [%] -3.237501

Avg. Trade [%] 0.28757

Max. Trade Duration 21 days 00:00:00

Avg. Trade Duration 7 days 00:00:00

Profit Factor 1.62024

Expectancy [%] 0.303059

SQN 0.969777

_strategy SMA_1

_equity_curve ...

_trades Size EntryB...

dtype: object

Leading to a pretty terrible return compared to B&H. Looking at the plots, it shows that the equity is more or less following the actual market trend.

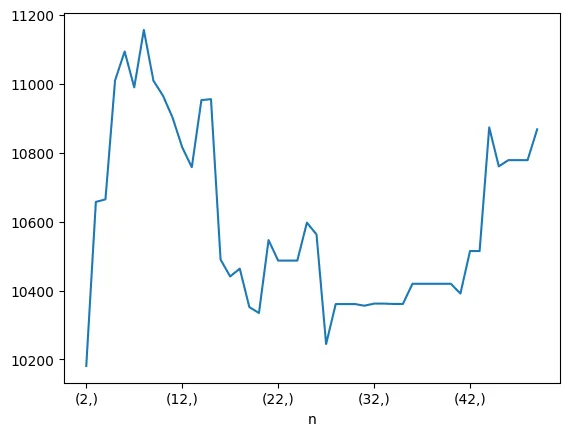

However, it might be the case that a more appropriate value for would result in a better return. For this, we can use optimisation. This usually takes quite a while to run but we're only considering 48 values.

stats, heatmap = bt.optimize(

n = range(2, 50, 1),

maximize='Equity Final [$]',

max_tries=200,

random_state=0,

return_heatmap=True)

heatmap.sort_values().tail()

n

7 10989.254414

9 11008.870673

5 11009.117410

6 11093.484994

8 11155.974974

Name: Equity Final [$], dtype: float64

Therefore, is the best. Side note, here's a graph showing the "Equity Final [$]" against .

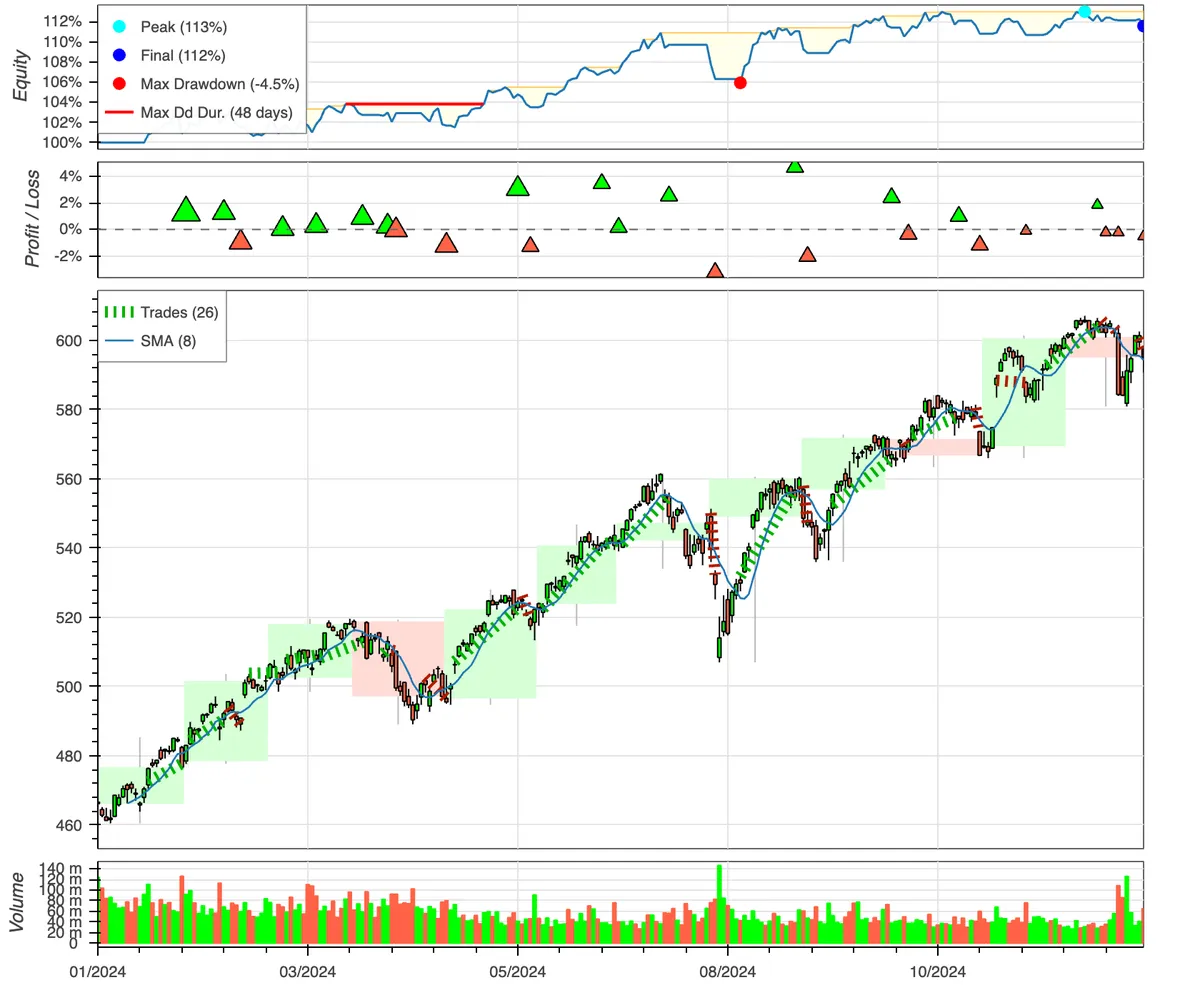

Performing the backtests again with this new value:

Start 2024-01-02 00:00:00

End 2024-12-27 00:00:00

Duration 360 days 00:00:00

Exposure Time [%] 74.8

Equity Final [$] 11155.974974

Equity Peak [$] 11299.692043

Return [%] 11.55975

Buy & Hold Return [%] 27.502881

Return (Ann.) [%] 11.657421

Volatility (Ann.) [%] 9.051886

Sharpe Ratio 1.287844

Sortino Ratio 2.112081

Calmar Ratio 2.605327

Max. Drawdown [%] -4.474455

Avg. Drawdown [%] -1.192903

Max. Drawdown Duration 48 days 00:00:00

Avg. Drawdown Duration 16 days 00:00:00

# Trades 26

Win Rate [%] 53.846154

Best Trade [%] 4.676358

Worst Trade [%] -3.237501

Avg. Trade [%] 0.431728

Max. Trade Duration 21 days 00:00:00

Avg. Trade Duration 9 days 00:00:00

Profit Factor 2.016307

Expectancy [%] 0.446811

SQN 1.243325

_strategy SMA_1

_equity_curve ...

_trades Size EntryB...

dtype: object

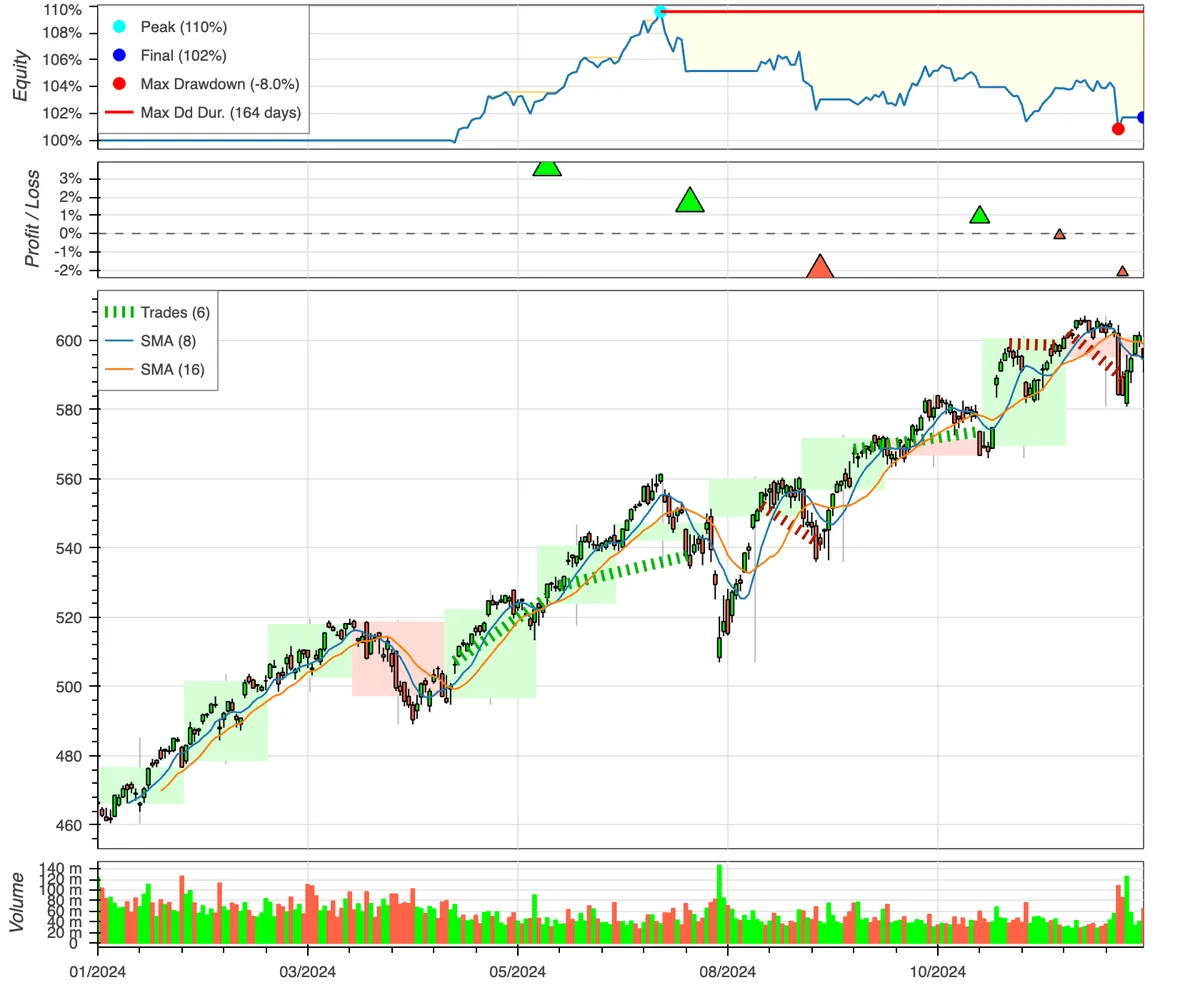

Still not great. Another strategy that involves SMA is to instead have two SMAs, a slow one and a fast one. If the fast moving one crosses over the slow moving one, we presume the stock is increasing. If the slow moving one crosses over the fast moving one, we presume the stock is decreasing.

The strategy I've used for this is below:

from backtesting import Strategy, Backtest

from backtesting.lib import crossover

class SMA_2(Strategy):

n_fast = 7

n_slow = 8

def init(self):

self.fast_sma = self.I(SMA, self.data.Close, self.n_fast, name = f"SMA ({self.n_fast})")

self.slow_sma = self.I(SMA, self.data.Close, self.n_slow, name = f"SMA ({self.n_slow})")

def next(self):

if crossover(self.fast_sma, self.slow_sma):

self.buy()

elif crossover(self.slow_sma, self.fast_sma):

self.position.close()

bt = Backtest(data, SMA_2, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

stats

Start 2024-01-02 00:00:00

End 2024-12-27 00:00:00

Duration 360 days 00:00:00

Exposure Time [%] 51.2

Equity Final [$] 10171.149641

Equity Peak [$] 10960.144571

Return [%] 1.711496

Buy & Hold Return [%] 27.502881

Return (Ann.) [%] 1.725306

Volatility (Ann.) [%] 7.548824

Sharpe Ratio 0.228553

Sortino Ratio 0.294205

Calmar Ratio 0.216094

Max. Drawdown [%] -7.984061

Avg. Drawdown [%] -1.914544

Max. Drawdown Duration 164 days 00:00:00

Avg. Drawdown Duration 36 days 00:00:00

# Trades 6

Win Rate [%] 50.0

Best Trade [%] 3.62912

Worst Trade [%] -2.121228

Avg. Trade [%] 0.306936

Max. Trade Duration 45 days 00:00:00

Avg. Trade Duration 29 days 00:00:00

Profit Factor 1.464802

Expectancy [%] 0.327355

SQN 0.315252

_strategy SMA_2

_equity_curve ...

_trades Size EntryBa...

dtype: object

With the following optimisation:

stats, heatmap = bt.optimize(

n_fast = range(2, 30, 1),

n_slow = range(2, 30, 1),

maximize='Equity Final [$]',

constraint=lambda p: p.n_fast < p.n_slow,

max_tries=200,

random_state=0,

return_heatmap=True)

heatmap.sort_values().tails()

n_fast n_slow

12 28 11307.240472

4 5 11424.670926

3 8 11497.370173

9 11618.003237

7 8 11757.419568

Name: Equity Final [$], dtype: float64

Not that great. The article made by backtesting.py used the second strategy on Google stock data and it looks like they got results that beat the market. I imagine it doesn't work on every stock though.