GDELT + Stock Data: Sentiment Score Backtesting

We've got our data, but its showing no correlation between variables we thought were correlated. I want to backtest it before completely giving up on this strategy. I'm gonna use the backtesting.py package in python to do this. Its pretty simple to use but has some limitations if we ever wanted to try more complex strategies. Using the following strategy:

from collections import Counter

from backtesting import Strategy, Backtest

from gdeltdoc import GdeltDoc, Filters

import pandas as pd

import matplotlib.pyplot as plt

import yfinance as yf

import numpy as np

from scipy.stats import pearsonr

START_DATE = "2017-01-01"

END_DATE = "2024-12-30"

TICKER = "SPY"

SEARCH_TERM = "economy"

# Set up GDELT filters

f = Filters(

keyword=SEARCH_TERM,

start_date=START_DATE,

end_date=END_DATE

)

gd = GdeltDoc()

articles = gd.article_search(f)

timeline = gd.timeline_search("timelinetone", f)

timeline

def get_tone(df):

tones = [0 for i in range(df.shape[0])]

timeline["datetime_clean"] = timeline.datetime.dt.date

for index, date in enumerate(df.index):

if date.date() in list(timeline.datetime.dt.date):

tones[index] = float(timeline[timeline.datetime_clean == date.date()]["Average Tone"])

else:

tones[index] = 0

return pd.Series(tones)

GOOG_Updated = yf.download(TICKER, start=START_DATE, end=END_DATE, multi_level_index=False)

class SentimentGDELT(Strategy):

buy_threshold = 0.5

close_threshold = -0.5

def init(self):

self.tone = self.I(get_tone, self.data.df)

def next(self):

if self.tone != 0:

if self.tone < self.buy_threshold:

self.buy()

elif self.tone > self.close_threshold:

self.position.close()

bt = Backtest(GOOG_Updated, SentimentGDELT, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

stats

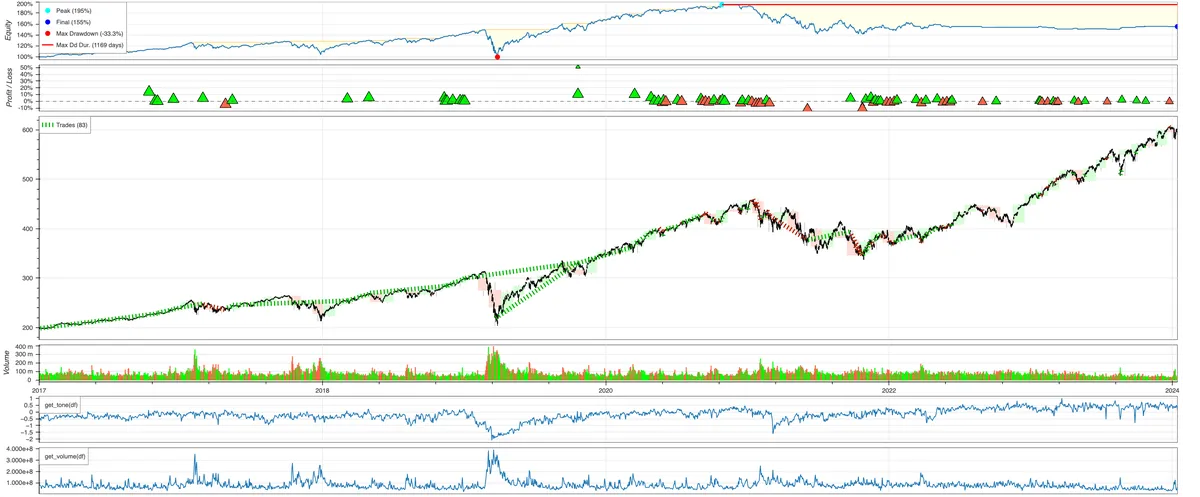

Which gave us the following plot:

Not too bad... at first sight. Looking at the statistics tells another story.

Start 2017-01-03 00:00:00

End 2024-12-27 00:00:00

Duration 2915 days 00:00:00

Exposure Time [%] 87.661692

Equity Final [$] 20945.559185

Equity Peak [$] 22627.686388

Return [%] 109.455592

Buy & Hold Return [%] 201.593354

Return (Ann.) [%] 9.712549

Volatility (Ann.) [%] 19.511283

Sharpe Ratio 0.497791

Sortino Ratio 0.762928

Calmar Ratio 0.289356

Max. Drawdown [%] -33.566098

Avg. Drawdown [%] -1.684377

Max. Drawdown Duration 1137 days 00:00:00

Avg. Drawdown Duration 25 days 00:00:00

# Trades 64

Win Rate [%] 53.125

Best Trade [%] 119.20113

Worst Trade [%] -16.862316

Avg. Trade [%] 1.12551

Max. Trade Duration 1756 days 00:00:00

Avg. Trade Duration 43 days 00:00:00

Profit Factor 3.550265

Expectancy [%] 1.791041

SQN 0.877532

_strategy SentimentGDELT

_equity_curve ...

_trades Size EntryB...

dtype: object

A common trend in my analysis is that I have yet to devise a strategy that outperforms the market itself. You can see that in the "Buy and Hold Return [%]" which shows the return you would of got if you just held on to the stock during the period being backtested.

Alas, back to the drawing board.